In 2025, competitive intelligence (CI) has outgrown the static quarterly report. Today it operates as a continuous system: I mean, monitoring markets in real time, flagging only the developments that demand attention, and delivering actionable context before the day begins. With the accelerating pace of change in AI, regulation, and go-to-market models, CI has shifted from a support activity to a critical business function. What follows is a breakdown of how modern competitive intelligence works, what’s required to build it effectively, and how to demonstrate its value in clear, measurable terms.

In this article, you’ll learn:

- The three forces reshaping CI: exploding signal volume, the rise of agentic AI, and the growing importance of trust and governance.

- How to run the modern CI loop without drowning in noise.

- Which sources consistently deliver outsized value, from pricing pages to hiring signals.

- What a practical 2025 CI stack looks like, and why tools amplify processes but don’t replace strategy.

- How agentic AI elevates CI from monitoring to meaningful moves across sales, product, and marketing.

- A real-world case study (TrajectoryAI) showing how automated monitoring turns scattered signals into action.

- The metrics that prove CI impact and win budget with executives.

- A 90-day playbook to build momentum and show early wins.

- Advanced moves for mature teams to weaponize CI into a competitive advantage.

- Common pitfalls that stall CI efforts, and how to avoid them.

Why CI looks different this year

So what is competitive intelligence in marketing? It is the process of gathering, analyzing, and using information about competitors, markets, and industry trends to make smarter strategic decisions. Let’s see what three forces reshaped CI:

- Signal volume exploded. Product releases, price changes, job postings, API docs, app reviews, social chatter, procurement filings, even firmware notes – well, every week brings a flood of micro-signals. The challenge is no longer finding information; it’s separating weak but meaningful signals from noisy ones.

- Agentic AI came of age. LLM-powered agents don’t just summarize. Instead, they monitor, compare, and escalate. They can track competitor websites, detect pricing deltas, map feature matrices, draft battlecards, and nudge owners when a counter-move is due. Think: CI interns who never need sleep and always cite sources.

- Trust and governance matter. Privacy laws (GDPR, CCPA/CPRA, and their cousins) plus platform T&Cs limit how you collect and use data. In 2025, smart CI teams are as proud of their data compliance as they are of their dashboards.

Key takeaway

Nowadays, competitive intelligence in marketing is all about filtering torrents of signals, deploying AI agents as tireless analysts, and staying compliant while you outsmart the market.

How to gather competitive intelligence

The main advice: consider a four-step loop “capture – interpret – activate – learn” running continuously.

- Capture. Automated monitors pull structured and unstructured data: website diffs, pricing pages, partner portals, developer docs, SEC filings, job listings, review sites, social and community forums, patent and trademark feeds. Bonus points for alt-data like web traffic estimates, app-store ranks, and product usage breadcrumbs from public changelogs.

- Interpret. LLMs classify signals by impact, confidence, and relevance. Vector search plus retrieval-augmented generation (RAG) lets you compare new info against your internal knowledge (win-loss notes, sales calls, support tickets). Output shouldn’t be a novel, instead, it should be a decision brief: “What changed, why it matters, how to respond.”

- Activate. Push the right intel to the right people at the right time. Sales gets a one-slide talk track in Slack. Product gets a Jira ticket with competitive deltas mapped to your roadmap. Marketing gets a positioning tweak and content ideas. No “everyone gets everything” blasts – respect attention spans like they’re an endangered species.

- Learn. Close the loop. Track what actions were taken, measure outcomes, and retrain your models and playbooks. If nobody used last month’s competitive teardown, the problem is that the CI wasn’t shaped for their moment of need.

Sources that punch above their weight

As of today, some inputs consistently deliver outsized value:

- Pricing and packaging pages. The quickest path to strategic intent. Watch for micro-movements: free-tier caps, trial length, bundling, usage-based thresholds.

- Release notes & public roadmaps. Feature cadence is a leading indicator of investment priorities. Pair with developer docs to understand implementation depth (a feature name ≠ capability parity).

- Hiring process. Hiring for a “Head of Ecosystem” or “Hardware Partnerships, LATAM” is a billboard for where the business is going.

- Support forums and app reviews. Real users say the quiet parts out loud: reliability complaints, onboarding friction, unmet needs.

- Partner and reseller listings. Who they sell with (or stop selling with) exposes alliances and channel bets.

- Events and webinars. Abstracts, speaker lineups, and demos reveal stories they’ll tell prospects next quarter.

Yes, scraping exists. No, you can’t ignore terms of service or privacy law. Use API first, respect robots.txt, and keep legal on speed dial. The “but the data was public” mantra isn’t a defense, just ask any lawyer.

Tooling: the 2025 CI stack

An effective CI stack is boring in the best way – modular, observable, and secure.

- Collection: Change-detection for web pages, connectors for CRMs, ticketing, and call transcripts, native APIs for social and app stores. Event-driven jobs beat fragile nightly scrapes.

- Storage: A mix of relational DB (clean, structured facts) and a vector database (semantic retrieval over messy text). Tag every artifact with source, timestamp, confidence, and usage rights.

- Reasoning: LLMs for summarization, classification, and comparison; small fine-tunes for your taxonomy; RAG to ground outputs in verified sources. Add guardrails to block hallucinations and enforce citation.

- Delivery: Slack/Teams alerts, CRM sidebars, a searchable CI hub, and auto-generated battlecards 2.0 (dynamic, role-aware, and versioned).

- Governance: Access control, data retention policies, and an audit trail of what was sent, to whom, and why.

If a tool promises to “replace your CI team,” smile politely and go away. Tools amplify processes, but they don’t invent one.

Agentic CI: from monitoring to moves

In 2025, CI agents handle the tasks that were once too fiddly for humans:

- Price and plan. When a competitor nudges a usage cap, the agent flags the affected segment, estimates ARR risk, and drafts a price-match or value-defend play.

- Positioning coherence check. Agents compare your web copy with rivals’ and flag overlaps or gaps, proposing new proof points backed by customer quotes.

- Feature parity scoring. For any opportunity, generate a “fit vs. rival” score with evidence links. Sales gets the green light to lean in or a caution to reframe.

- Scenario triggers. If two competitors announce partnerships within a region, spin up a scenario brief: impact, counter-alliances, and GTM moves.

Give agents clear policies (what to watch, what constitutes a material change) and escalation rules (who gets pinged, what SLOs apply). Otherwise, you’ve built an eager intern with a foghorn.

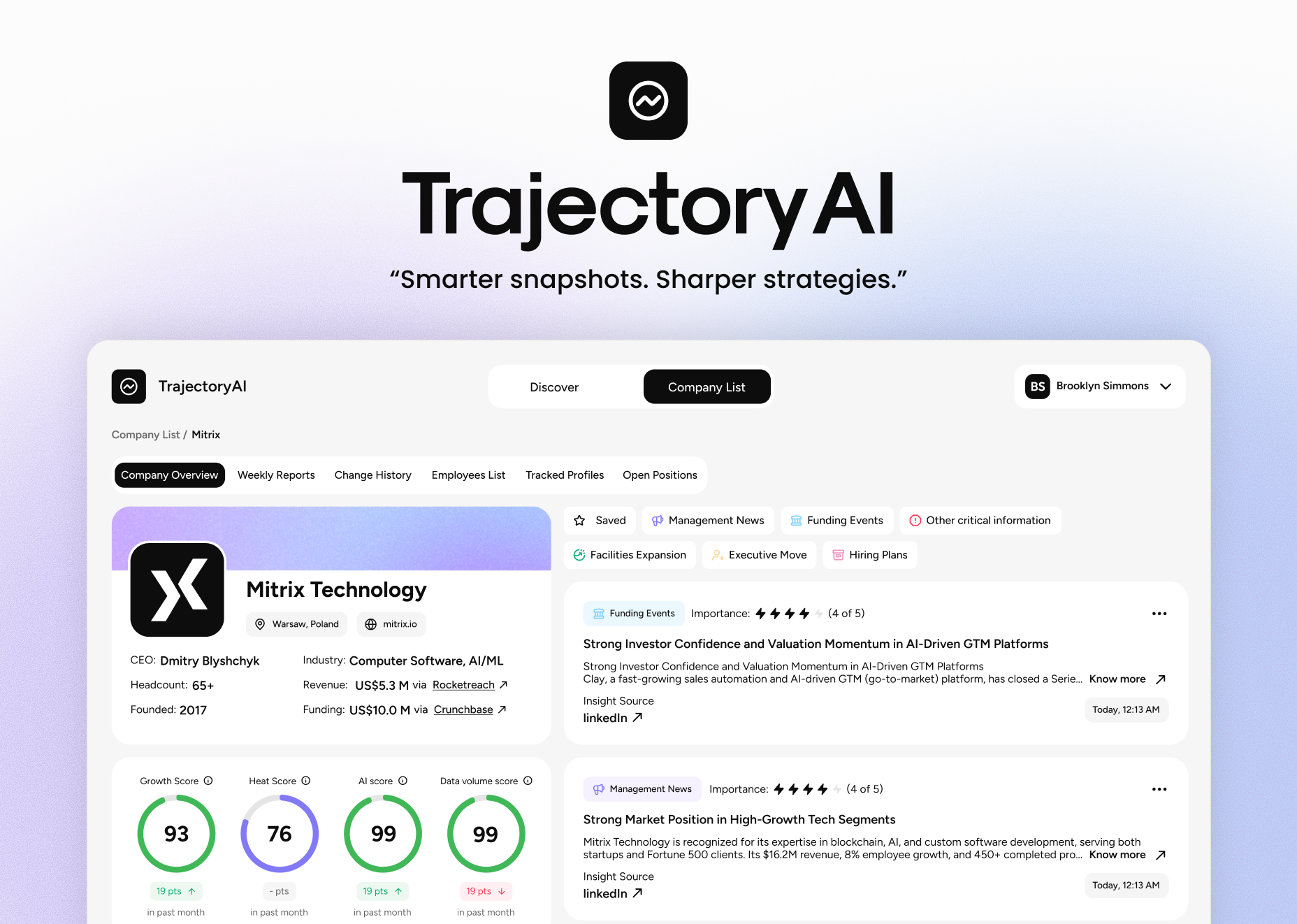

TrajectoryAI: the use case

Here at Mitrix, we constantly struggled to keep track of the companies that mattered most to us – partners and prospects. Big-name platforms like ZoomInfo or Clay claimed broad coverage, but when it came to smaller businesses, the data was patchy, outdated, or missing altogether.

That gap became our daily frustration: scattered signals, endless manual searches, and no way to turn information into a clear picture. So we built what we couldn’t find – TrajectoryAI.

TrajectoryAI started as an internal project, designed to answer one simple question: “What’s really happening with the companies we follow, right now?” The main challenges included:

- Big databases overlook SMBs or misrepresent them.

- Signals were scattered across websites, job postings, press releases, and social.

- Manually checking updates wasted time and often caused us to miss important shifts.

This way, we needed a way to see what changed week to week without drowning in noise.

Solution

TrajectoryAI gathers information from the following sources and provides accurate and timely insights in one place:

- General info. Websites, blogs, press releases, job postings, and news portals.

- Social networks (including corporate and private accounts). Facebook, Instagram, LinkedIn.

- Data aggregators. Crunchbase, Apollo, Clay, etc.

- Search. Global search, AI search.

TrajectoryAI

TrajectoryAI

TrajectoryAI turns scattered market data into a clear action plan. You pick the companies and people to track, and the tool does all the heavy lifting, gathering snapshots from multiple sources, filtering out the noise, spotting trends, and surfacing insights you can actually act on.

- You create a list of companies and people you’re interested in.

- The platform pulls data snapshots from four sources, using smart algorithms to filter out the noise.

- Then TrajectoryAI compares data across different time periods to spot changes, deltas, and emerging trends.

- AI draws insights and suggests directions for deeper analysis and action.

Key implemented features

- Automatic “Company update” feed. The tool compares activity week over week and generates a short report highlighting what changed: new hires or departures, product or pricing updates, fresh press or regulatory mentions, etc.

- Reasoning AI. Detect non-obvious relationships and strategic patterns.

- Intelligent change tracking. Powered by AI to uncover emerging organizational trends.

- LLMS + NER. Makes it possible to extract names, roles, and entities from unstructured content.

Results

We built Trajectory AI for our own needs to cut through the daily chaos of scattered signals and gain a structured, reliable view of the companies we follow. Instead of raw data dumps, the tool highlights signals and strategic shifts we can act on. For each company, we can evaluate how deeply they are embracing AI/LLM technologies, giving us an edge in assessing partners and competitors.

- Scalable monitoring. We can now track as many companies as needed without adding headcount or extra manual work.

- Time and cost savings. No more endless hours of analyst labor spent collecting and cleaning data; the tool does all the heavy lifting.

- Customizable tracking. We set snapshot frequency and prioritize sources that matter most to us, so the updates always stay relevant.

- Seamless integration. Through our API and MCP server, TrajectoryAI fits neatly into our existing AI workflows.

Are you interested in trying TrajectoryAI? Contact us today!

Deliverables that actually get used

If you’re still shipping 20-page PDFs, may the open-rate odds be ever in your favor. Instead:

- One-slide briefs. “What changed / Why it matters / Do this next.” Link to evidence, of course.

- Dynamic battlecards. Auto-update win themes, objection handling, and proof points. Push situational snippets into the CRM based on opportunity stage and competitor field.

- Release shadow notes. For each competitor release, a short take: claims vs. reality, how to demo around it, what to watch next.

- Quarterly “moves and countermoves” review. A concise narrative of strategy arcs.

Metrics to observe

CI earns budget when it earns outcomes. Track a handful of business-linked KPIs:

- Win-rate lift in competitor-tagged deals where CI assets were used.

- Sales cycle time vs. competitor presence (CI-assisted vs. baseline).

- Competitive rate (are we catching the right rivals early?).

- Content adoption and retention (views are vanity, reuse in live deals is sanity).

- Forecast accuracy for competitive pressure (are our “threat levels” predictive?).

- Time-to-alert for material competitor changes and time-to-action downstream.

Tie each metric to an owner. If everything is “a shared responsibility,” nothing moves.

Ethics, compliance, and policies

Talking about SEO and competitive intelligence, just because you can collect something doesn’t mean you should. Golden rules:

- No deception (fake identities, pretexting).

- Respect IP and TOS. If a site forbids automated collection, ask for partnership or use verified third-party data.

- Pseudonymize where possible. Don’t store personal data you don’t need.

- Cite sources. Every claim in a customer-facing asset should be traceable.

- Red team big claims. Before launching a “we’re faster/cheaper/better” message, run a teardown and get legal eyes on it.

Practical playbook: your first 90 days

Days 1-30: Get signals and a spine.

- List top 5 competitors and top 10 pages per competitor to monitor (pricing, plans, docs, release notes, roadmaps).

- Stand up a minimal stack: change-detection + vector store + LLM with RAG.

- Define severity levels and escalation rules.

- Ship one “What changed this week” digest to a pilot audience.

Days 31-60: Make it useful for revenue.

- Build dynamic battlecards for the top three competitors; integrate into CRM.

- Train an agent to auto-draft talk tracks when a competitor release hits.

- Run two competitive enablement sessions; capture objections and refutes.

Days 61-90: Prove impact and scale.

- Instrument usage and tie to opportunity outcomes.

- Launch pricing/packaging diffing alerts with recommended actions.

- Formalize the CI CoE charter, including governance and quarterly OKRs.

If you can’t show at least one deal saved or one roadmap decision influenced by Day 90, simplify. CI should feel like a superpower, not a second inbox.

Advanced moves for teams with momentum

Once the basics are humming, it’s time to step into the big leagues. Proper competitive intelligence bends insights into leverage before anyone else sees them coming. Here are advanced plays for teams with momentum who want to turn CI into a real advantage.

- Win-loss at scale. Use call transcripts and outcome data to classify loss reasons by rival and segment; feed findings into product and pricing experiments.

- Messaging entropy monitor. Agents scan your and competitors’ pages to detect copycat drift or narrative holes before prospects do.

- Scenario planning with live triggers. Pair macro indicators (rates, regulation changes) with competitive moves to generate near-term scenarios and playbooks.

- Partner cartography. Map alliances and marketplace listings to see who’s cornering distribution. Channel conflicts often reveal strategy seams you can exploit.

- Teardown guilds. Quarterly, host a cross-functional lab where PMs, SEs, and sellers reverse-demo a competitor. Capture the talk track and objections live.

The point isn’t to collect trivia about competitors, but to weaponize intelligence into sharper products, tighter pitches, and moves that shift the field in your favor. Run these plays consistently, and you don’t just keep up – you change the game.

Common pitfalls (and how to avoid them)

Competitive intelligence can sharpen your edge or dull it completely if mismanaged. The difference often comes down to avoiding a few all-too-common traps.

- Hallucinated insights. Ground every summary with citations; block ungrounded outputs. If the model “thinks” it knows, it doesn’t.

- Flooding the org. Alerts without relevance filters turn into white noise. Route by role, stage, and account list.

- Vanity dashboards. If a chart doesn’t change a decision, it’s decor.

- Treating CI as a side gig. CI needs ownership, not “whoever has time.

- One-size-fits-all assets. SDRs, AEs, PMMs, and PMs need different cuts of the same truth.

Competitive intelligence fails when it’s noisy, shallow, or ownerless. To avoid the traps (such as hallucinated insights, irrelevant alerts, vanity dashboards, ad-hoc ownership, and one-size-fits-all outputs), anchor CI in verifiable data, role-specific delivery, and clear accountability.

Summing up

In 2025, competitive intelligence is an always-on operating system for growth. It blends compliant data collection, agentic AI, and ruthless relevance to turn market noise into timely action. Teams that do CI well don’t just react faster: they build sharper products and tell stories that land. Set the loop, arm your agents, ship crisp deliverables, and measure outcomes. And keep it human, surely.

The edge doesn’t come from having more data, but from making better decisions with it. The companies that win are those that treat CI not as a dusty report, but as a living system, constantly tuned, tested, and trusted across the org. When CI becomes muscle memory, it starts being impactful.